SUBJECT: COMMERCE

CLASS: SS1

DATE:

TERM: 3RD TERM

WEEK 7

TOPIC: THE CHEQUE SYSTEM

CONTENTS

- Parties to a cheque

- Advantages of payment by cheque

- Types of cheques

- Dishonoured cheques

CHEQUE

A cheque is a bill of exchange drawn on a banker payable on demand

PARTIES TO A CHEQUE

There are three parties involved with a cheque namely:

- The Drawer - .i.e. the person who issues the cheque

- The Drawee - .i.e. the bank being instructed to pay the money

- The Payee - .i.e. the person named on the cheque to receive the money from the bank.

The drawee of the cheque also becomes the payee when the amount payable on the cheque is to be received by himself.

ADVANTAGES OF PAYMENT BY CHEQUE

- Convenience. Cheque may be made out for any sum of money and requires no change. They are therefore a convenient means of making payments.

- Security. It is safer to carry cheque than cash for security reasons.

- Easy to trace: cheques are numbered and may therefore be easily traced when the need arises.

- It provides a record or payments and receipts. i.e. it is needless for the payee to send a receipt for such payment.

- Portability: cheques are easy to carry about and therefore make carrying large sums of money unnecessary.

- Reduced risk of loss: a cheque is an absolutely safe means of payment especially when crossed as the risk of loss is eliminated

- Payment may be stopped by the drawer. E.g. so as to prevent fraud.

- The use of cheques reduces the demand for bank notes and coins.

- The use of cheques saves the time and energy involved in counting cash.

TYPES OF CHEQUES

- Bearer Cheques: These are worded “Pay…… or Bearer” and would be paid by the bank to whoever is presenting the cheque for payment whether the name on the cheque is his or not. Such cheques are not as safe as order cheques. A bearer cheque does not require endorsement when negotiating it (i.e. transferring it to another person).

- Order Cheque: Such cheques are worded “pay…………… or Order” and would only be paid to the person or firm whose name appear on it, or to his order – i.e. any other person to whom the payee endorses the cheque to.

- Open Cheque: These are cheques that are not crossed and can therefore be presented and cashed over the counter of the bank on which it is drawn. Open cheque are not safe as crossed cheques as there is a risk that it can be paid to a wrong person.

- Crossed Cheques: These are cheques that have two parallel lines drawn across the face with or without the words “& Co.” “A/C payee only”, “Not Negotiable” etc. crossed cheques cannot be cashed over the counter of the bank but must be paid into a bank current account. They are therefore safer than open cheques.

Crossed cheque can be made open by the drawer writing the words “Pay Cash” on it and adding his signature immediately after the words “Pay Cash”

TYPES OF CROSSING

There are two types of crossing on cheques namely general crossing and special crossing.

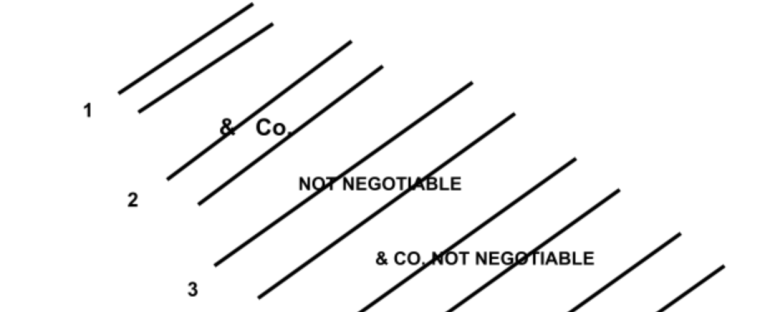

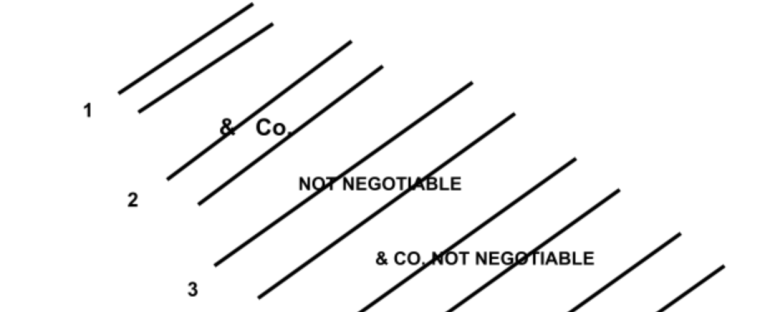

- General Crossing: This is effected by drawing two parallel lines across the face of a cheque with or without the word “& Co.” “Not Negotiable”, “A/C Payee Only”. e.t.c. as found below.

EFFECTS OF GENERAL CROSSING

General crossing makes such a cheque payable into a bank account for collection i.e. it cannot be cashed over the counter. It therefore affords protection against fraud.

Crossing a cheque does not necessarily prevent if from being stolen. However it makes is easy for the thief to be traced since he has to use a bank account to cash such a cheque.

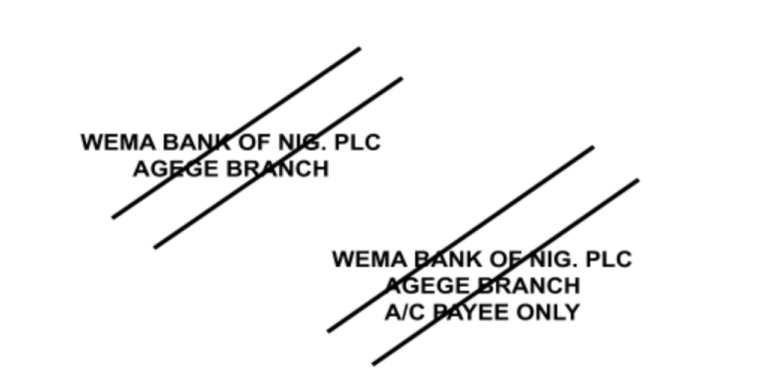

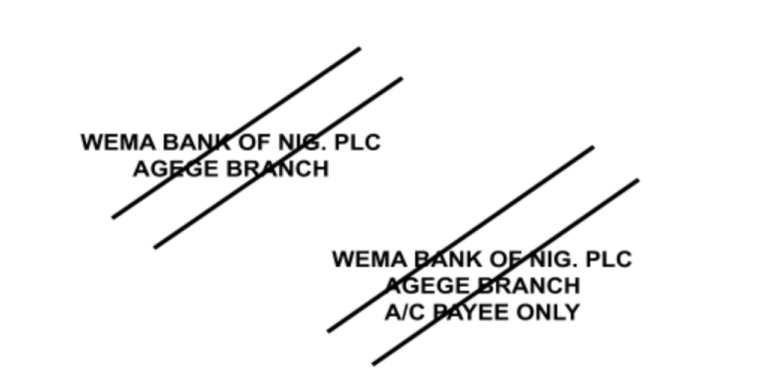

- Special Crossing: This is effected by writing the name of a bank across the face of the cheque with or without the parallel lines and the word “& Co.” “Not Negotiable” “A/C Payee Only” etc as found below.

EFFECTS OF SPECIAL CROSSING

Special crossing limits payments of such a cheque into the bank whose name is written on the face of that cheque. This ensures a greater and stricter protection against fraud.

DEFINITION OF TERMS ASSOCIATED WITH CHEQUE

- Post – Dated Cheque: This is a cheque that is presented for payment before the date shown on it. The bank will not pay until the specified date is due.

- Stale cheque: This is a cheque that is presented for payment more than six months after the specified date. The bank will not pay this cheque.

- Endorsement: To endorse a cheque means that the payee has to append his signature at the back of the cheque.

- Certified Cheque: This is a cheque on which a bank has signified that the drawer has enough fund to pay and that, in any case, the cheque cannot be dishonoured.

- Dishonoured cheque: (i.e. “Bounced” Cheque). A dishonoured cheque is one which a banker on whom it is drawn has for some reasons refused to pay on presentation for payment by the payee. Before returning a dishonoured cheque to his customer the banker usually writes on it reason for dishouring e.g “R/D” (i.e. Refer to Drawer) “Account closed”, DAR i.e. (Drawer Attention Required), Orders Not to Pay” etc.

REASONS FOR DISHONOURING A CHEQUE.

- Insufficient fund

- When payment is stopped by the drawer

- Irregular signature (i.e. Drawer Signature Irregular)

- Difference in figure and word

- Cheque mutilated

- Alteration on cheque not endorsed by the drawer.

- Stale cheque

- Post dated cheque

- Death of drawer

- Insanity of the drawer

- Bankruptcy of the drawer

- Account closed

- Account frozen on court order/Garnishee order

- No Account i.e. Account does not exist e.t.c

REVIEW QUESTIONS

- Explain six reasons why a trader would prefer the use of cheque to cash for large payments.

- Explain each of the following (a) Order cheque (b) Certified cheque (c) Crossed cheque

- What is meant by the following words written on a cheque (a) Not Negotiable (b) Accounts Payee only.

- State two safeguards which could prevent the fraudulent use of a cheque.

WEEKEND ASSIGNMENT

- Which of the following abbreviations indicates a banker’s unwillingness to honour a cheque (a) R/D (b) B/F (c) B/D (d) C/F

- Which of the following reduces the risk of carrying large amount of money (a) Bank draft (b) Wallet (c) Vouchers (d) Cash till

- The fee which the bank charges for services render to their current account customers is (a) Commission on turnover (b) Bank rate (c) Minimum rediscount rate (d) Interest

- Legal tender consists of (a) Cheques and coins (b) Bank draft and cheques (c) Currency notes and coins (d) Money order and currency notes

- The drawer of a cheque is usually the (a) Banker (b) Creditor (c) Debtor (d) Payee

THEORY

- List three parties to a cheque

- State five reasons why a bank will dishonour its customers cheque.

READING ASSIGNMENT

- Essential Commerce for SSS by O. A. Longe Page 86 – 92

- Comprehensive Commerce for SSS by J. U Anyaele Page 187 – 195

GENERAL EVALUATION QUESTIONS

- Explain five features of itinerant trading

- State five features of a supermarket

- List five disadvantages of pre-packaging

- State six factors which a bank manager considers in granting loans to customers

- In which seven ways does branding affect the consumer